Banking Services

Managing your finances efficiently begins with the right banking solutions. We offer expert assistance in opening Bank Accounts—Savings, Current, or Business—to help you carry out smooth and secure transactions, manage funds, and build a solid financial base.

- Home

- Banking Services

Overview

Loans Provided by Banks for the Individual & MSME Sectors –

Banks play a vital role in supporting economic growth by offering a wide range of loan products tailored to the needs of both individuals and the MSME (Micro, Small, and Medium Enterprise) sector.

Each type of loan is designed to meet specific purposes, whether it’s buying a home, managing personal expenses, expanding a business, or meeting working capital needs.

Below is an overview of popular loans offered by banks for these two key segments.

1️⃣ Loans for Individuals

Banks offer various loans to help individuals achieve their personal goals and manage finances:

Home Loans

Offered to purchase, construct, or renovate a house. Banks provide competitive interest rates and long tenures (up to 30 years), making home ownership accessible for many.Personal Loans

Unsecured loans used for any personal purpose such as medical expenses, weddings, education, or travel. These are usually quick to process but have higher interest rates compared to secured loans.Education Loans

Specifically designed to fund higher education in India or abroad. Covers tuition fees, living expenses, and other education-related costs, with repayment starting after a moratorium period.Vehicle Loans

For purchasing two-wheelers or four-wheelers. Banks finance a significant portion of the cost at attractive interest rates and flexible repayment options.Loan Against Property (LAP)

Individuals can pledge residential or commercial property to avail a higher loan amount for personal or business use at relatively lower interest rates.Consumer Durable Loans

For purchasing electronics, appliances, and other consumer goods with easy EMIs.

2️⃣ Loans for the MSME Sector

MSMEs are the backbone of the economy, and banks offer specialized loans to help them grow and thrive:

Working Capital Loans

To finance day-to-day operational expenses such as inventory, raw materials, and salaries. Offered as overdrafts, cash credit, or short-term loans.Term Loans

For purchasing machinery, equipment, or setting up new production units. These are typically medium- to long-term loans with fixed repayment schedules.Overdraft Facilities

Enables MSMEs to withdraw more than their account balance up to a sanctioned limit, helping manage cash flow gaps.- Bill Discounting

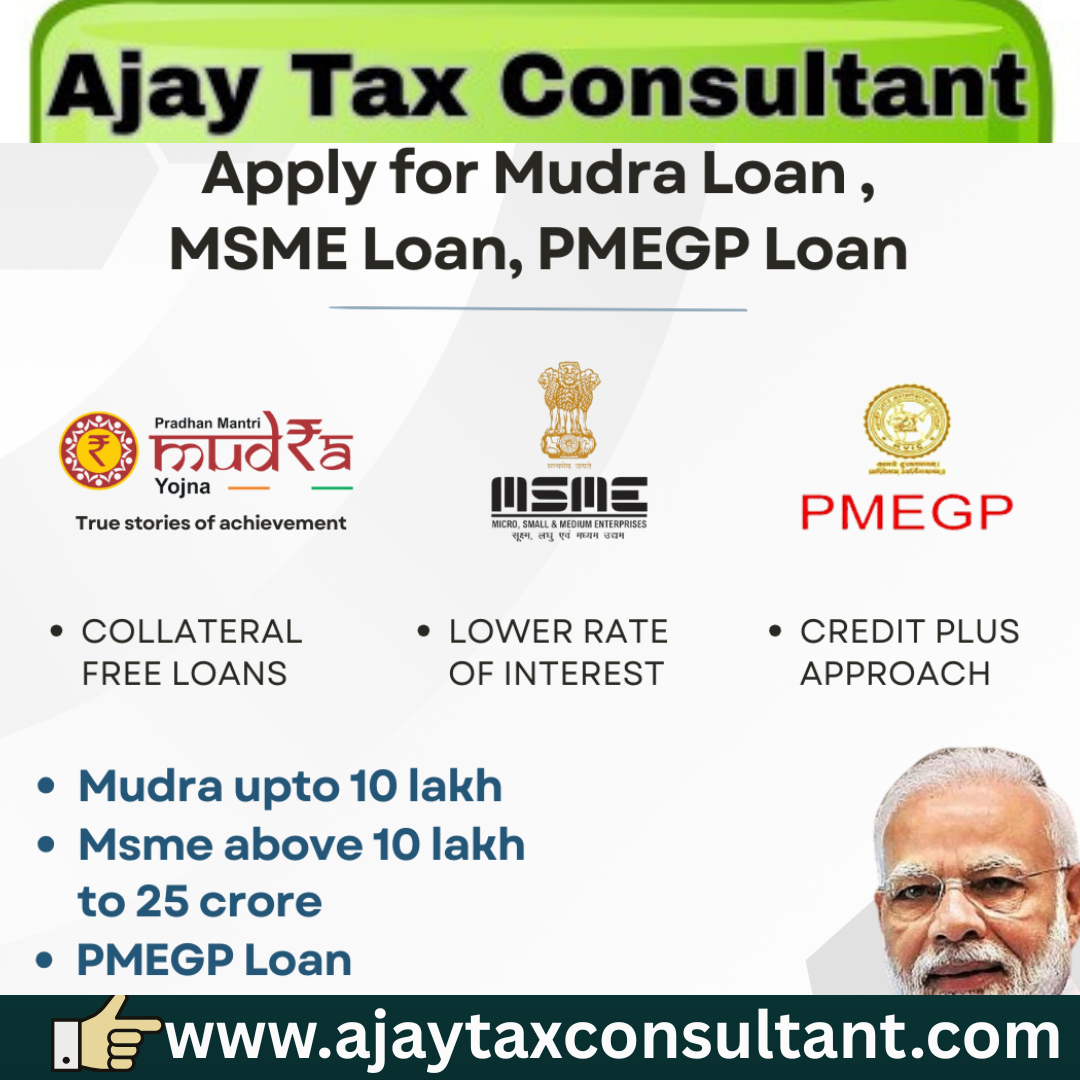

Banks buy a business’s outstanding invoices at a discount, providing instant liquidity without waiting for customers to pay. Mudra Loans

Part of the Government of India’s initiative for micro and small enterprises. Offered under Shishu, Kishor, and Tarun categories, depending on the loan amount.Stand-Up India Loans

For promoting entrepreneurship among women and SC/ST borrowers. Banks offer loans between ₹10 lakh and ₹1 crore for setting up new businesses.Collateral-Free Loans (CGTMSE Scheme)

Loans backed by the government’s credit guarantee fund to help MSMEs access finance without needing to pledge security.Export Credit

Special loans to support MSMEs involved in international trade, helping them manage production and shipping costs.

Conclusion

Banks provide a diverse range of loan products designed to empower individuals and fuel the growth of MSMEs.

By choosing the right loan, borrowers can meet their financial needs, invest in their future, and contribute to the economy’s development.

Whether it’s buying a home, expanding a business, or simply managing cash flow, banks are a reliable partner in making these goals a reality.

Eligibility

Far far away, behind the word mountains, far from the countries Vokalia and Consonantia, there live the blind texts. Separated they live in Bookmarksgrove right at the coast

✅ Mandatory Documents for 80-IAC Registration

DPIIT Recognition Certificate

Ensure your startup is recognized by the Department for Promotion of Industry and Internal Trade (DPIIT).Certificate of Incorporation / LLP Deed

Depending on your business structure:Private Limited Company: Memorandum of Association (MoA)

Limited Liability Partnership (LLP): LLP Agreementtax2win.instartupindia.gov.in+8kanakkupillai.com+8kmgcollp.com+8

Board Resolution (if applicable)

A resolution from the board approving the application for tax exemption.PAN Card of the Entity

Permanent Account Number issued to your startup.Financial Statements

CA-certified Balance Sheets and Profit & Loss Statements for the past three financial years or since incorporation.Income Tax Returns (ITRs)

Filed ITRs for the past three years or since the startup’s inception.Pitch Deck

A comprehensive presentation detailing your business model, market analysis, competitive advantage, and financial projections.Video Presentation

A short video (as per 80-IAC guidelines) explaining your startup’s mission, product/service offerings, and innovation.Proof of Funding (if applicable)

Documents such as term sheets, investment agreements, or bank statements showing external funding received.Section 56 Exemption Certificate (if applicable)

If your startup has obtained an exemption under Section 56 (Angel Tax), include the certificate.Employment Details (if applicable)

Information regarding employees, especially those with advanced degrees (M.Tech/PhD), publications, or from specific categories (e.g., SC/ST, persons with disabilities).Authorized Signatory Identification

Aadhar card of the authorized signatory and a letter of authorization.

📝 Application Process Overview

Obtain DPIIT Recognition

Register your startup on the Startup India portal and apply for DPIIT recognition.Prepare Required Documents

Gather and organize all the documents listed above in the specified formats.Submit 80-IAC Application

Log in to the Startup India portal, navigate to the ‘Tax Exemption under Section 80-IAC’ section, fill out the application form, and upload the necessary documents.Await Approval

The Inter-Ministerial Board (IMB) will review your application. The approval process may take several weeks to months.

Far far away, behind the word mountains, far from the countries Vokalia and Consonantia, there live the blind texts. Separated they live in Bookmarksgrove right at the coast

Far far away, behind the word mountains, far from the countries Vokalia and Consonantia, there live the blind texts. Separated they live in Bookmarksgrove right at the coast